Advertisement

-

Published Date

October 18, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

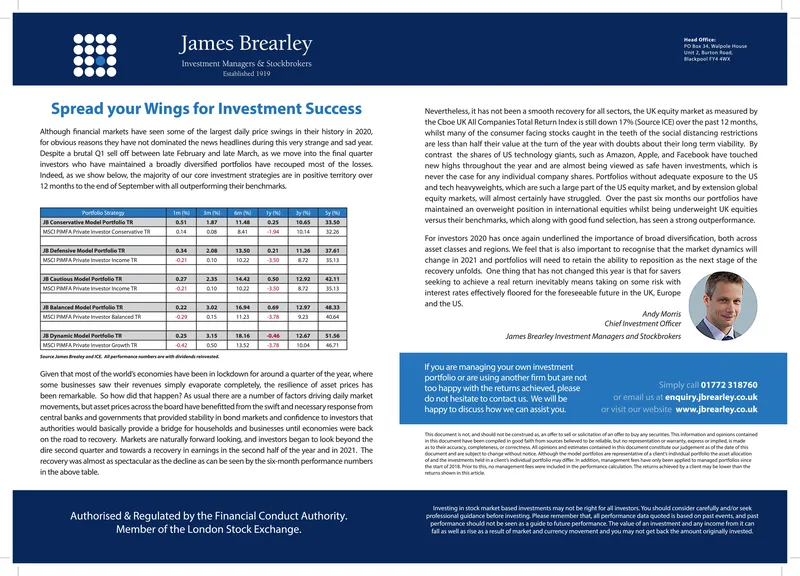

James Brearley Head ofce PO Box 34, Wipole Houe UN 3. Burton Rsad. ackpool Y4 WX Investment Managers & Stockbrokers Established 1919 Spread your Wings for Investment Success Although financial markets have seen some of the largest daily price swings in their history in 2020, for obvious reasons they have not dominated the news headlines during this very strange and sad year. Despite a brutal Q1 sell off between late February and late March, as we move into the final quarter investors who have maintained a broadly diversified portfolios have recouped most of the losses. Indeed, as we show below, the majority of our core investment strategies are in positive territory over 12 months to the end of September with all outperforming their benchmarks. Nevertheless, it has not been a smooth recovery for all sectors, the UK equity market as measured by the Cboe UK All Companies Total Return Index is still down 17% (Source ICE) over the past 12 months, whilst many of the consumer facing stocks caught in the teeth of the social distancing restrictions are less than half their value at the turm of the year with doubts about their long term viability. By contrast the shares of US technology giants, such as Amazon, Apple, and Facebook have touched new highs throughout the year and are almost being viewed as safe haven investments, which is never the case for any individual company shares. Portfolios without adequate exposure to the US and tech heavyweights, which are sucha large part of the US equity market, and by extension global equity markets, will almost certainly have struggled. Over the past six months our portfolios have maintained an overweight position in international equities whilst being underweight UK equities versus their benchmarks, which along with good fund selection, has seen a strong outperformance. Portolio Seategy J Conservative Model Portelo TR MSCI PMAPivate levestor Conservative T Sy 0.51 11.48 eas 10.65 a14 0.08 841 194 1014 32.26 For investors 2020 has once again underlined the importance of broad diversification, both across asset classes and regions. We feel that is also important to recognise that the market dynamics will change in 2021 and portfolios will need to retain the ability to reposition as the next stage of the recovery unfolds. One thing that has not changed this year is that for savers seeking to achieve a real return inevitably means taking on some risk with interest rates effectively floored for the foreseeable future in the UK, Europe and the US. 37.41 11 Defensive Model Pertfelio TR 034 2.08 13.50 0.21 116 MSCI PMEA Private Investor income TR 021 0.10 10.22 -1.50 72 JB Cautious Model Pertfelio TR MSCI PMFA Pivate investor income TR 0.27 2.35 42.11 14.42 0.50 12.82 021 010 10.22 A50 872 3513 Balanced Model Portfelio TR MSCI PMAPvate investor Balanced TR 0.22 3.02 164 0.69 12.97 48.33 Andy Morris Chief Investment Oficer 0.29 0.15 11.23 -3.78 9.23 40.64 JDynamic Model Perttule TR MSCI PIMFA Private investor Growth TR Sene ames realey anCE Apetmanmbera videnevested James Brearley investment Managers and Stockbrokers 0.25 3.15 18.16 12.67 S1.56 050 4671 If you are managing your own investment portfolio or are using another firm but are not too happy with the returns achieved, please do not hesitate to contact us. We will be Given that most of the world's economies have been in lockdown for around a quarter of the year, where some businesses saw their revenues simply evaporate completely, the resilience of asset prikes has been remarkable. So how did that happen? As usual there are a number of factors driving daily market movements, but asset prices across the board have benefitted from the swift and necessary response from central banks and governments that provided stability in bond markets and confidence to investors that authorities would basically provide a bridge for households and businesses until economies were back on the road to recovery. Markets are naturaly forward looking, and investors began to look beyond the dire second quarter and towards a recovery in earnings in the second half of the year and in 2021. The recovery was almost as spectacular as the decline as can be seen by the six-month performance numbers Simply call 01772 318760 or email us at enquiry.jbrearley.co.uk or visit our website www.jbrearley.co.uk happy to discuss how we can assist you. This documentinot and shout nor be conaed ,a in this document have been compled in good tah om souron beleved to be neliabie, but ne eprmentation or waanty.gre or impled made mnera seor alonton of an ofe o buy any secites ainmanon and opinions containe thei acy.completeness, or coce Alonand mts conaned inthis document cane ou dgeentof the date of th of and the inetments heid inaclene individal portfolo may difer in addition, management fe have only been appled to managed portolos ince in the above table. the tat of 20 Por managemefees weecuded pertmancelaion the retus achieved by a ent may be lowerthan the ntum shown in thi artide Authorised & Regulated by the Financial Conduct Authority. Member of the London Stock Exchange. Investing in stock market based investments may not be right for all investors. You should consider canefully and/or seek professional guidance before investing. Pease remember that, all performance data quoted is based on pant events, and pant performance should not be seen as a guide to future performance The value of an imvestment and any income from it can fall as well as rise as a result of market and currency movement and you may not get back the amount originally invested. James Brearley Head ofce PO Box 34, Wipole Houe UN 3. Burton Rsad. ackpool Y4 WX Investment Managers & Stockbrokers Established 1919 Spread your Wings for Investment Success Although financial markets have seen some of the largest daily price swings in their history in 2020, for obvious reasons they have not dominated the news headlines during this very strange and sad year. Despite a brutal Q1 sell off between late February and late March, as we move into the final quarter investors who have maintained a broadly diversified portfolios have recouped most of the losses. Indeed, as we show below, the majority of our core investment strategies are in positive territory over 12 months to the end of September with all outperforming their benchmarks. Nevertheless, it has not been a smooth recovery for all sectors, the UK equity market as measured by the Cboe UK All Companies Total Return Index is still down 17% (Source ICE) over the past 12 months, whilst many of the consumer facing stocks caught in the teeth of the social distancing restrictions are less than half their value at the turm of the year with doubts about their long term viability. By contrast the shares of US technology giants, such as Amazon, Apple, and Facebook have touched new highs throughout the year and are almost being viewed as safe haven investments, which is never the case for any individual company shares. Portfolios without adequate exposure to the US and tech heavyweights, which are sucha large part of the US equity market, and by extension global equity markets, will almost certainly have struggled. Over the past six months our portfolios have maintained an overweight position in international equities whilst being underweight UK equities versus their benchmarks, which along with good fund selection, has seen a strong outperformance. Portolio Seategy J Conservative Model Portelo TR MSCI PMAPivate levestor Conservative T Sy 0.51 11.48 eas 10.65 a14 0.08 841 194 1014 32.26 For investors 2020 has once again underlined the importance of broad diversification, both across asset classes and regions. We feel that is also important to recognise that the market dynamics will change in 2021 and portfolios will need to retain the ability to reposition as the next stage of the recovery unfolds. One thing that has not changed this year is that for savers seeking to achieve a real return inevitably means taking on some risk with interest rates effectively floored for the foreseeable future in the UK, Europe and the US. 37.41 11 Defensive Model Pertfelio TR 034 2.08 13.50 0.21 116 MSCI PMEA Private Investor income TR 021 0.10 10.22 -1.50 72 JB Cautious Model Pertfelio TR MSCI PMFA Pivate investor income TR 0.27 2.35 42.11 14.42 0.50 12.82 021 010 10.22 A50 872 3513 Balanced Model Portfelio TR MSCI PMAPvate investor Balanced TR 0.22 3.02 164 0.69 12.97 48.33 Andy Morris Chief Investment Oficer 0.29 0.15 11.23 -3.78 9.23 40.64 JDynamic Model Perttule TR MSCI PIMFA Private investor Growth TR Sene ames realey anCE Apetmanmbera videnevested James Brearley investment Managers and Stockbrokers 0.25 3.15 18.16 12.67 S1.56 050 4671 If you are managing your own investment portfolio or are using another firm but are not too happy with the returns achieved, please do not hesitate to contact us. We will be Given that most of the world's economies have been in lockdown for around a quarter of the year, where some businesses saw their revenues simply evaporate completely, the resilience of asset prikes has been remarkable. So how did that happen? As usual there are a number of factors driving daily market movements, but asset prices across the board have benefitted from the swift and necessary response from central banks and governments that provided stability in bond markets and confidence to investors that authorities would basically provide a bridge for households and businesses until economies were back on the road to recovery. Markets are naturaly forward looking, and investors began to look beyond the dire second quarter and towards a recovery in earnings in the second half of the year and in 2021. The recovery was almost as spectacular as the decline as can be seen by the six-month performance numbers Simply call 01772 318760 or email us at enquiry.jbrearley.co.uk or visit our website www.jbrearley.co.uk happy to discuss how we can assist you. This documentinot and shout nor be conaed ,a in this document have been compled in good tah om souron beleved to be neliabie, but ne eprmentation or waanty.gre or impled made mnera seor alonton of an ofe o buy any secites ainmanon and opinions containe thei acy.completeness, or coce Alonand mts conaned inthis document cane ou dgeentof the date of th of and the inetments heid inaclene individal portfolo may difer in addition, management fe have only been appled to managed portolos ince in the above table. the tat of 20 Por managemefees weecuded pertmancelaion the retus achieved by a ent may be lowerthan the ntum shown in thi artide Authorised & Regulated by the Financial Conduct Authority. Member of the London Stock Exchange. Investing in stock market based investments may not be right for all investors. You should consider canefully and/or seek professional guidance before investing. Pease remember that, all performance data quoted is based on pant events, and pant performance should not be seen as a guide to future performance The value of an imvestment and any income from it can fall as well as rise as a result of market and currency movement and you may not get back the amount originally invested.